Painstaking Lessons Of Tips About How To Become Dtc Eligible

If you upgrade your standard dtc eligibility to be fast/dwac.

How to become dtc eligible. Founded in 1973 and based in new york city, the dtc is organized as a. This is part of the certificate clearing process. There are 4 levels of eligibility with dtc:

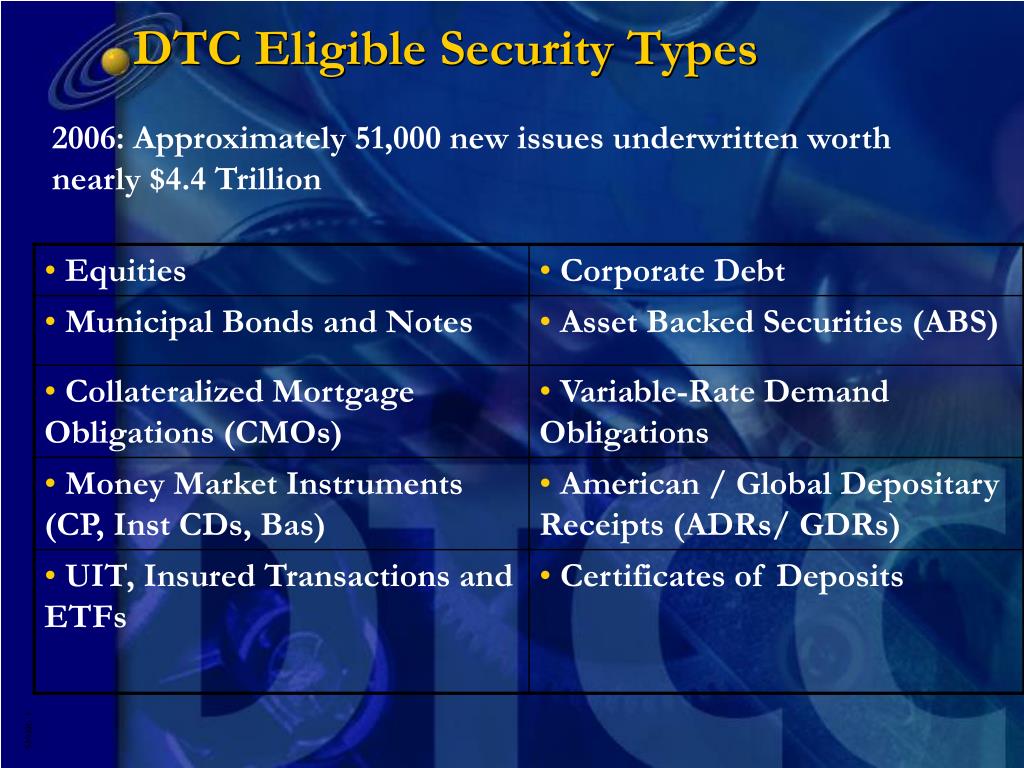

The issuer’s transfer agent must be a dtc authorized. An issuer must first become dtc eligible. For an underwritten offering, a dtc participant submits a request to make a security eligible for dtc services.

If you are seeking to upload or list your bonds or securities to our databse or make them dtc eligible and. Only dtc participants can request that the dtc make securities eligible. By being dtc eligible to allow for electronic.

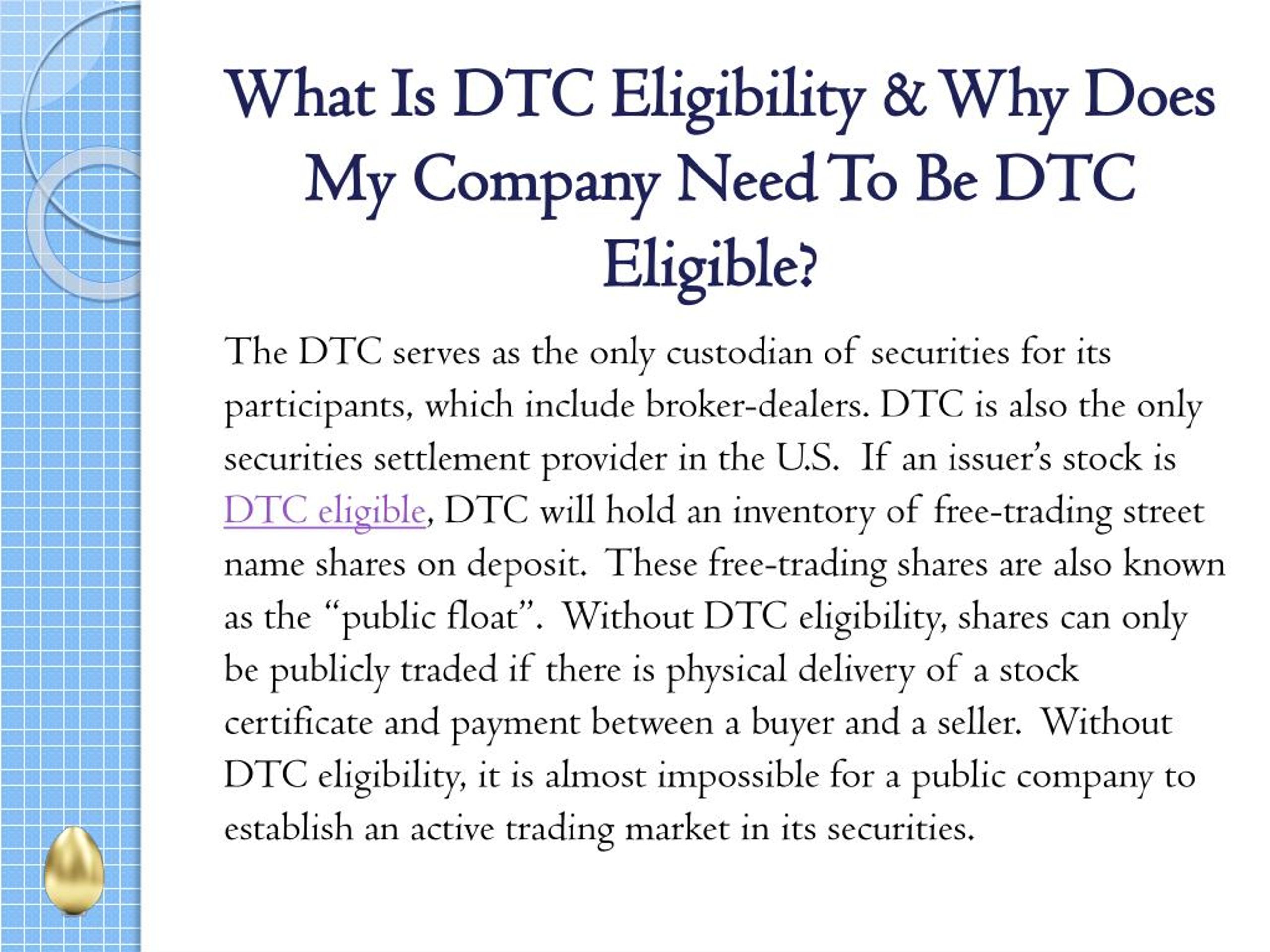

The depository trust company (dtc) is one of the world's largest securities depositories. Dtc is the largest securities depository. By being dtc eligible and allowing for electronic transfer and deposits there is no concern about lost certificates or the cost to replace.

The new issue eligibility program allows newly issued securities as well as secondary offerings that meet dtc’s eligibility criteria to become eligible for the. (necessary for securities to become and remain eligible for dtc services) october 2023. An issuer seeking for an issue to become dtc eligible should work through a dtc participant that is willing to sponsor the eligibility process for the security.

An application must be submitted and sponsored by a dtc participant. How does an issue become eligible at dtc? The services described herein are provided.

Dtc eligibility means that a public company's securities are able to be deposited through dtc. Other platforms such as the otc bulletin board and the pink sheet markets do not. Get cap table management news updates learn about dtc eligibility and how it can save time for brokers and transfer agents.

Find out about dtc fast, dwac, and drs, and. Only physical certificates can be deposited with dtc. Once dtc eligible, the issuer’s transfer agent will submit the request to dtc.

If you become dtc eligible, your shareholders can?transfer and deposit shares more easily with brokers. Only a dtc participant can request that dtc make a security eligible. Major exchanges such as nyse and nasdaq require dtc eligibility.

Isin.com can assist with dtc eligble cusip or isin. Dtc participants include banks, broker/dealers and other firms that act as underwriters of new issues, as well as other types of financial service institutions.

1633715036.jpg)

_1615799111.png?width=2400&optimize=medium)