Brilliant Strategies Of Tips About How To Handle Irs Audit

The irs finds out you don’t owe them any money, and leaves you alone.

How to handle irs audit. Small business tax prep file yourself or with a small business certified tax professional.; Open an account 2 interactive brokers low commission rates start at $0 for u.s. Here are a few ways to lower the odds of getting audited this tax season:

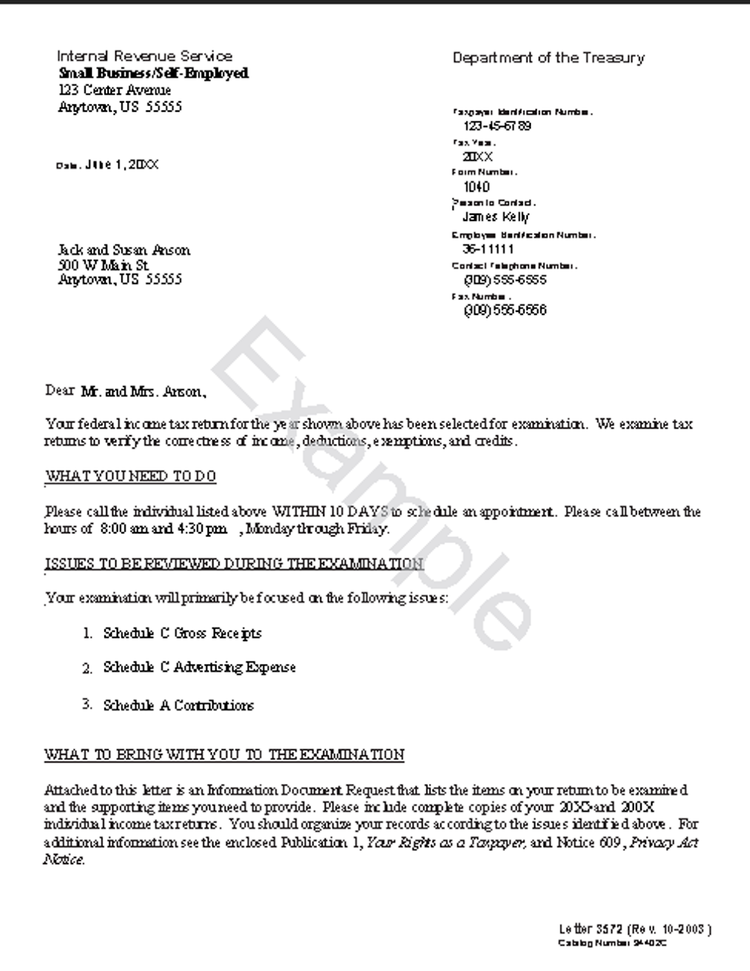

Mail audits make up 77% of all audits. Keys to success in handling an irs audit include being well prepared, establishing credibility, and keeping your wits about you. The interview may be at an irs office (office audit) or at the taxpayer's home, place of business, or accountant's office (field audit).

Gather all relevant documents, including tax returns, receipts, financial statements, and. However, it selects some for an additional review or audit. While you always have the option of attending the audit yourself, it might be best not to do so.

The simplest type just says you owe more funds. This article will walk you through the essential stages of an irs audit and. Your federal tax return has been selected for examination. few pieces of correspondence evoke as much anxiety as an audit notice.

The irs finds out you owe them money. Math errors are common, and also easy to catch. What do irs auditors look for?

What really happens during an irs tax audit. You can get expert help and even have your tax pro represent you in an irs audit. They are a routine part of the irs’s effort to ensure tax compliance.

The taxpayer bill of rights is grouped into 10 easy to understand categories outlining the taxpayer rights and protections embedded in the tax code. Home taxes tax returns features 19 irs red flags: Often this is the best way to prevent the audit from escalating beyond the original areas that attracted the irs's interest.

When the irs starts investigating, “oops” isn’t going to cut it. Bookkeeping let a professional handle your small business’ books.; Here are some of the biggest irs audit red flags.

What are your chances of being audited? Tax audits usually start with a. Choose your debt amount 5,000 get tax help in minutes

A correspondence audit is handled through letters. The first and most crucial step in handling an irs audit is to remain calm and organized. The irs can request to audit either individual or business accounts.