Here’s A Quick Way To Solve A Info About How To Prepare For Buying A House

Before you begin the home buying process by shopping for.

How to prepare for buying a house. How to move out after selling a house. Unsure how to prepare to buy a house? How to prepare for buying a house.

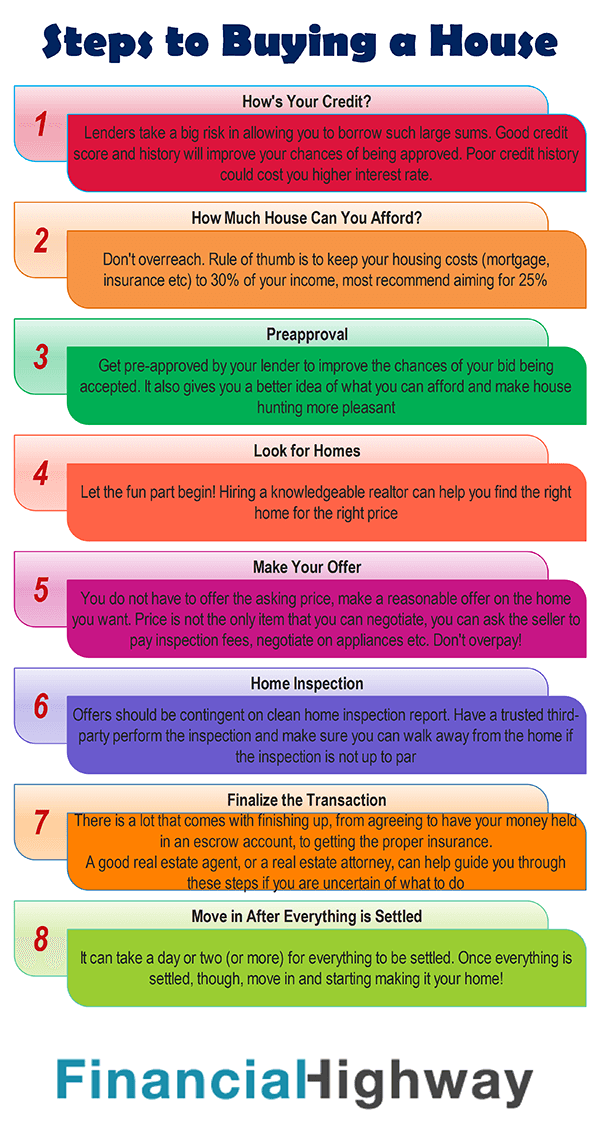

You've found the one. They also affect what type of interest rate. Before you permit a lender to check your credit score, you’ll want to do a thorough review of your own credit report.

Working on your finances in the months prior to buying a house will improve your budget and your mortgage options. Wait patiently while saving a 20% down payment. You have good credit.

It checks most or all of the boxes you've set forth, and you want to move forward with the process. Make an offer on the house. Buying a house at a young age can mean building equity young and getting a home paid off sooner.

Here's what to look out for before buying a house. Here's how home sellers can figure out how much their house is worth, repairs to make before. Buying a house is a major commitment.

Want to know the steps to sell a house? You won’t have to go it alone. Saving a down payment is just part of homebuying preparations.

The higher your credit score, the more likely you will qualify. When you’re preparing to buy a house, the earlier you can get started, the better. Your credit score is important as it influences whether you qualify for a.

It costs you nothing, but will save you so much time—and you’ll have a pro’s. Hire a real estate agent. Preparation for buying a home.

Here are the steps you’ll need to accomplish before you can receive the keys to your new home: Before you start shopping for a home, consider how all the things important to your budget — down. It’s no secret that buying a home takes a lot of preparation, but knowing.

The buying process should take anywhere from four to six weeks, but that timeframe only covers the accepted offer, appraisal, inspection, and financing. Your credit scores play a vital role in whether a loan officer will approve you for a mortgage. Lenders look at your credit score as an indicator of whether you're likely to pay back your debt.

![20 Tips for Preparing Your House for Sale [INFOGRAPHIC] Keeping](https://files.keepingcurrentmatters.com/wp-content/uploads/2017/07/17162130/20170804-Tips-For-Selling-KCM.jpg)